Description

With Helios it’s possible to create marketing campaigns, promotions and new products without code, so that financial companies can offer new products to their clients quickly and easily.

Helios works across the internal divisions of a financial organization and allows each product to be personalized.

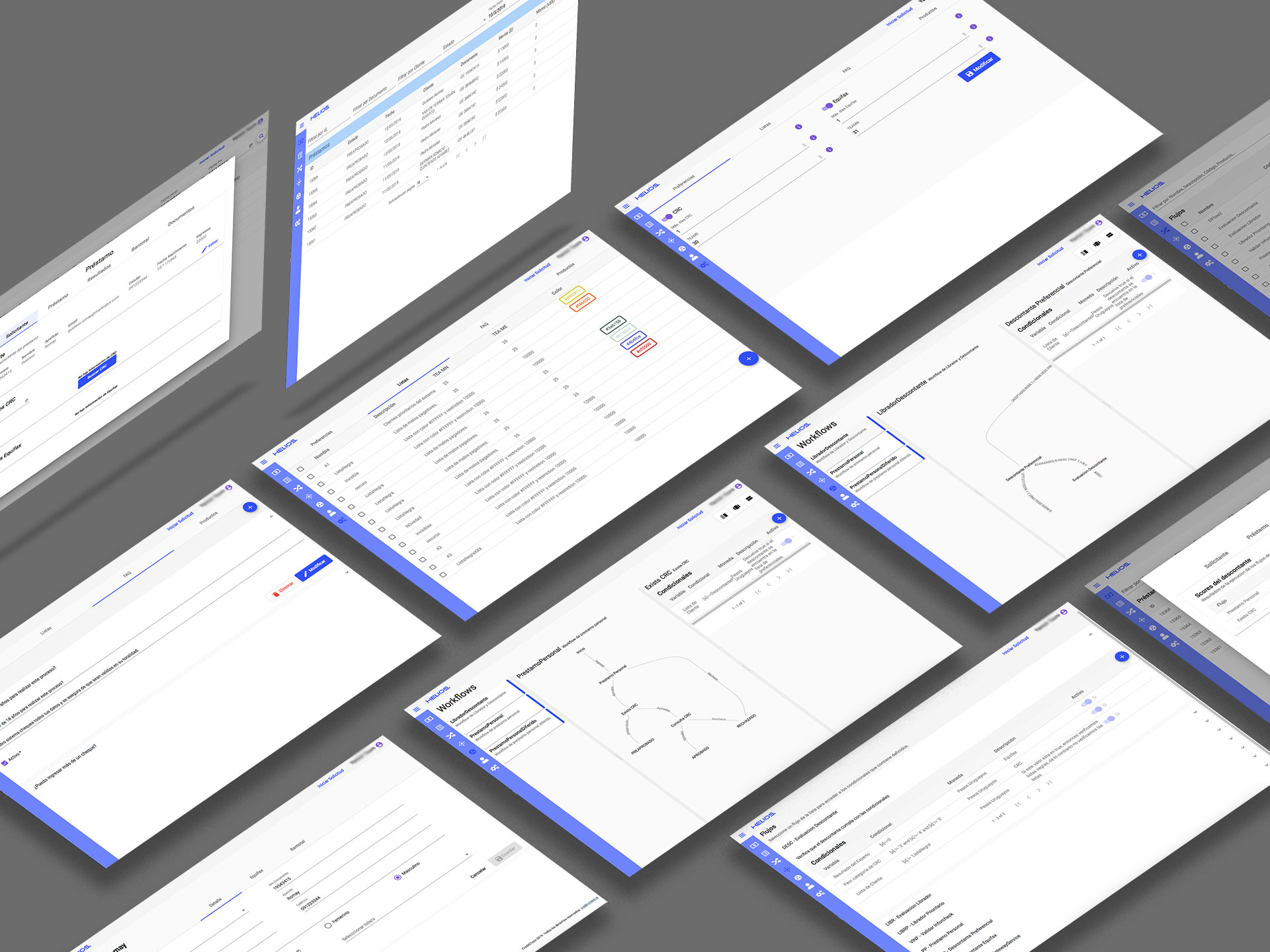

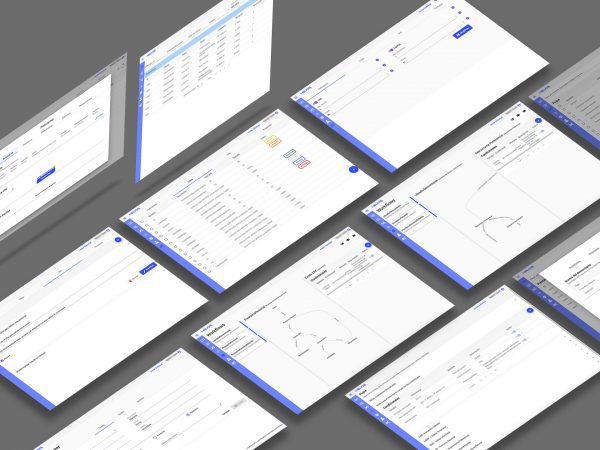

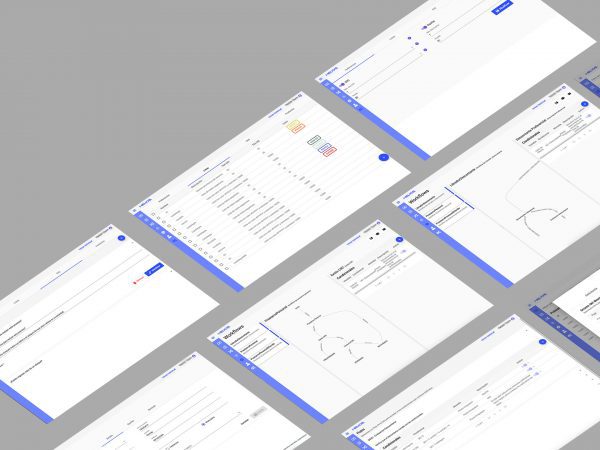

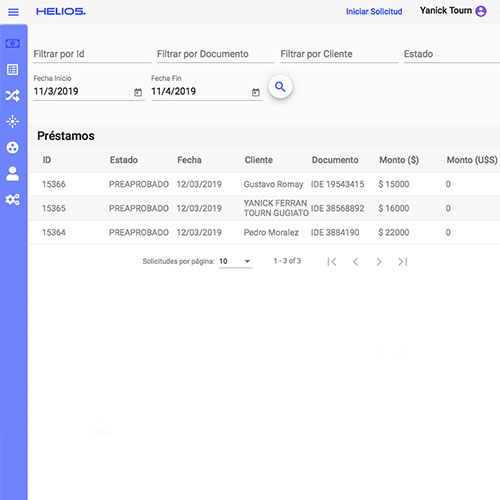

The system is divided into modules: Loans, Pay Check Advances, Bill Pay Loans and Documents. It can be integrated with digital sales channels such as Facebook, WhatsApp bot, chatbots and landing pages.

The modules can be used as part of the Helios suite or independently through their own API. The solution also integrates out of the box with external services such as Equifax, Central de Riesgos and InforCheck.

The system is designed for companies that market financial products and strongly tend to sell and attract their customers online.

Benefits

- Reduces time needed to release new financial products to market.

- Expedites approval of financial products, making decisions happen in close to real time.

- Consolidates customer data to simplify decision making, cross-selling and upselling.

- Reduces operating costs for queries to system providers such as Equifax, by performing customized workflows for each customer segment.

- Provides a modern financial product manager that is easy to configure through workflows and diagrams.

- Builds custom product requests by sales channel (landing, mobile, chat bot).

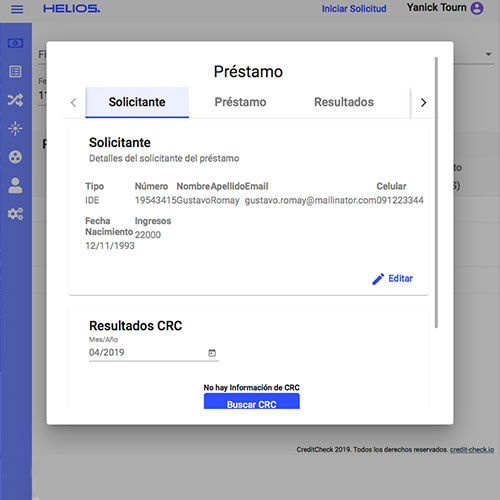

- Receives requests for loans, bill pay loans and pay check advances in a single, unified place. Verifies all data from lenders and borrowers in a fast and integrated way, assisting the financial organization to assign and plan product requests.

Use cases

- Process applications at maximum speed: Open a new application and make an integrated review of the applicant’s information, credit score, account balances, documents, proof of address, utility statements and more. Verify requester’s profile according to the procedures established by the company’s personalized workflows. All in one place. Then assign subsequent steps accordingly with team members.

- Create different approval rules for different customer segments: Define customer lists according to optimal profiles. Run custom workflows to categorize customer bases. Offer customized products to customers in minutes.

- Expand or restrict in real time: Select a product, edit its associated workflow and add, modify or remove approval conditions at run time.

Success stories

- Microfin: Installation and configuration of real-time approval decision workflows. Installation and configuration of landing pages. Installation and configuration of documents API.

- Guay Credit: Installation and configuration of Pay Check Advance decision workflows for lenders and borrowers. Installation and configuration of landing pages.