Enabling our clients to focus on what really matters by freeing up their time.

Solving financial processes based on a Software as a Service model for Financial and non-financial institutions.

Version-Less

Pay-per-use

Ready to use

Sales

Aumenta las ventas a

través de un funnel de

conversión multicanal.

Time-to-market

Deployment times

reduction.

producción.

Key Benefits

Flexibility

Infrastructure and product

according to the

business needs.

Specialization

Focus on improving

client´s experience.

de los clientes.

Security and compliance

Complying with international

standards, keeping all data

secured and available.

Processes and innovation

Capture the innovation available

ein Bantotal, solving

banking processes.

Products

BSaaS For Financial Institutions

Loan allocation and loanbook management through all the onboarding and follow up processes.

Features

Multichanel funnel

Accounting

Papework validation

Data analytics

Scoring

Invoicing

Loanbook management

Disbursement and collection

Loan simulator

BSaaS For Fintech

Accounting, taxes and loan calculations solution

Features

![]() Loan simulator

Loan simulator

![]() Accounting

Accounting

![]() Disbursement and collection

Disbursement and collection

![]() Invoicing

Invoicing

![]() Data

Data

BSaaS For Retail

Enable non-financial institutions to allocate and manage loans.

Features

![]() Loan simulator

Loan simulator

![]() Accounting

Accounting

![]() Loanbook management

Loanbook management

![]() Data

Data

Services

We´ve developed a series of specialized services that enable our customers to focus on what really matters: develop their business.

Data migration

System configuration

Support and assistance

Technical training

DevOps services

Tailored services

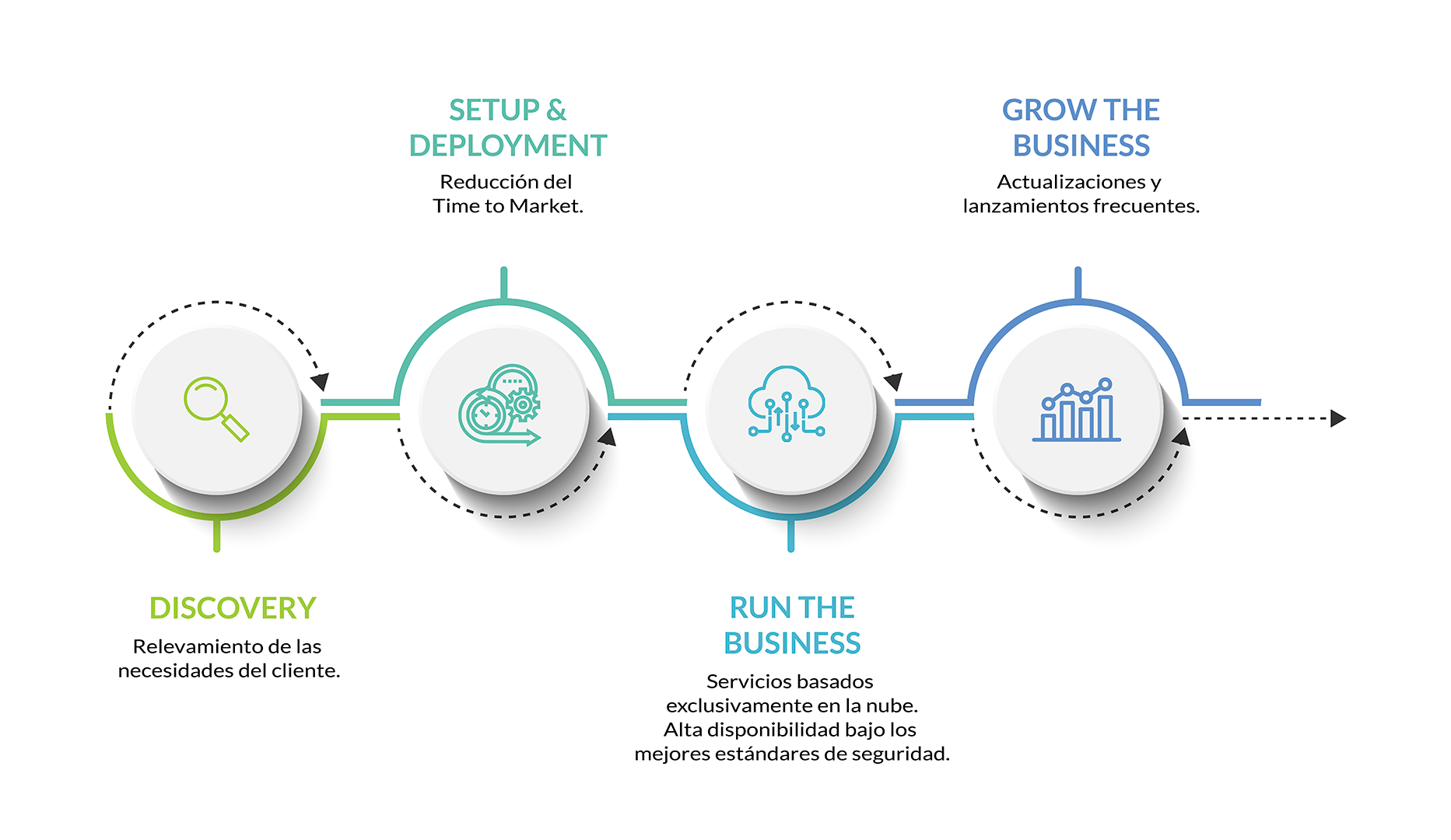

Client´s roadmap

A proposal is delivered after our specialists’ survey. Once approved, we´ll ensure the deployment of the solution is in place within three months’ time. All technical and daily operations processes are managed within so that the client´s team focuses on developing their core business, worry free. Frequent updates and improvements ensure the solution is always current and up to date.

Explore our solutions

-

Bantotal Core

Bantotal Core is the centerpiece of our platform and solves all mission critical banking processes for Banks, Finance Companies, Fintech, Digital Banks, e-Commerce, Banking as a Service providers, etc. -

Microfinance

Bantotal Microfinance is the benchmark solution for microfinance companies, supporting the operation of the most important institutions in Latin America. This has enabled the incorporation of industry best practices and processes. -

Comex

Bantotal Comex is the solution that allows financial institutions to develop the business of Letters of Credit, Guarantees, Collections, Drafts and International Checks. -

Treasury

Bantotal Treasury allows the Financial Institution to offer its customers a global vision of its portfolio through a scalable system in terms of product variety and business volume. -

Mutual Funds

Bantotal Mutual Funds is a solution that allows the Financial Institution to offer their customers access to a diverse portfolio, starting from a reduced volume of money, seeking to give liquidity, security and rentability to said savings. -

Compliance

It is the solution that ensures Financial Institutions are in compliance with the regulations of the country it operates in, as well as the Foreign Account Tax Compliance Act (FATCA) and the International Financial Reporting Standards (IFRS). -

Cash Management

Bantotal Cash Management allows financial institutions to offer their customers payment, collection and transfer services, outsourcing their treasury and saving time and money. -

Banking as a Service

Bantotal Banking as a Service (BaaS) is the service that allows banks to offer their infrastructure and services so that Fintechs can provide banking products without the need for a banking license. -

Embedded Finance

Bantotal Finanças Incorporadas is the solution that allows financial institutions to integrate banking products into people's daily lives through collaborative agreements with non-financial organizations. -

BPay

BPay is a payment solution certified in multiple markets, which allows instant interbank transfers through different channels, considering the current norms and standards. -

BPeople

BPeople focuses on developing digital banking solutions that have a memorable impact on the customer experiences of financial institutions, offering innovation, market knowledge and implementation methodologies. -

BData

BData specializes in the development of data science and analysis methods and techniques, so that financial institutions can have observability, make intelligent decisions and optimize their business performance. -

BSaaS

BSaaS develops a set of specialized services to solve the financial processes required by financial and non-financial institutions under the Software as a Service modality. -

BStore

BStore provides Financial Institutions with relevant innovation that integrates and complements the platform so they can improve and grow in today's business context.

Contact us