Description

¿Qué es?

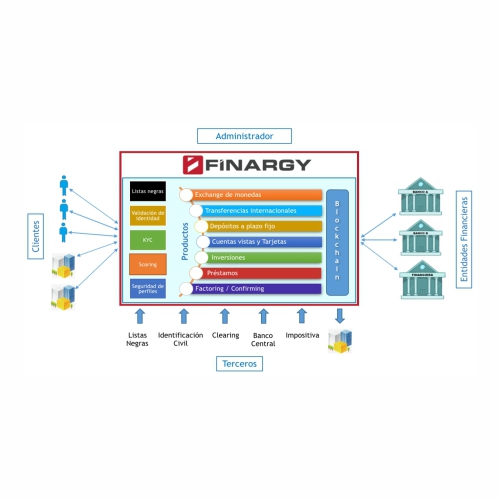

FINARGY es una plataforma en la nube basada en tecnología Blockchain y Open APIs que permite la colaboración entre Entidades Financieras para que puedan ser más eficientes y, a su vez, proveer servicios innovadores mediante un nuevo canal de distribución, atractivo y de bajo costo.

FINARGY se posiciona como una plataforma para distribución de servicios financieros diseñado para la era del Open Banking.

¿Qué características tiene?

FINARGY está basado en la tecnología Blockchain, que por primera vez, permite generar valor mediante la sinergia y colaboración entre Entidades Financieras en forma ágil, segura, transparente, con privacidad y confidencialidad. A su vez, incluye APIs para conectarse a los sistemas financieros de las instituciones.

Estas características permiten optimizar procesos comunes a múltiples Entidades Financieras sin comprometer la privacidad y confidencialidad de la información. Los procesos se realizan una única vez para todas las instituciones, reduciendo costos y tiempos, y mejorando la experiencia del cliente.

Por otro lado, permiten mantener un único canal de distribución de productos financieros, lo que permite llegar a más clientes a un menor costo, tomar mejores decisiones de riesgos y captura de clientes, y obtener mayor escala rápidamente.

FINARGY es una plataforma basada en servicios, modular, parametrizable, escalable, integrable, con analítica de datos y protección de la privacidad y seguridad de la información para todos los integrantes del ecosistema.

¿Cuáles son los beneficios que otorga a los bancos ?

- Reducción de costos basado en:

- Menos clientes en sucursales físicas.

- Menor costo de KYC por ser compartido.

- Menor riesgo gracias a Scoring compartido.

- Menor costo para captación de clientes.

- Menor tiempo de onboarding.

- Mayores ingresos debido a:

- Captación de nuevos clientes por nuevo canal de ventas:

- Grandes EF acceden a nuevos mercados

- Pequeñas EF logran mayor escala

- Mejor experiencia de cliente

- Mayor rentabilidad basada en un mejor conocimiento del cliente utilizando Analítica de Datos.

- Incorporar flexibilidad e innovación propias de las Fintech a la trayectoria y confianza generada por las Entidades Financieras tradicionales.

FINARGY está basado en tecnología Blockchain y Open APIs lo que permite la colaboración entre Entidades Financieras para que puedan ser más eficientes en procesos como KYC, Scoring y Notarización de documentos. El producto permite optimizar procesos comunes sin comprometer la privacidad y confidencialidad de la información. Los procesos se realizan una única vez para todas las instituciones, reduciendo costos y tiempos, y mejorando la experiencia del cliente.

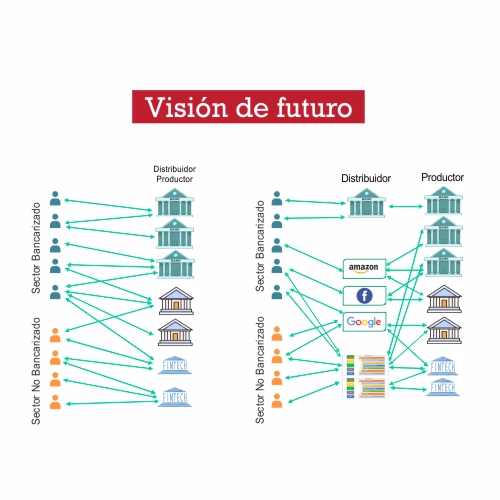

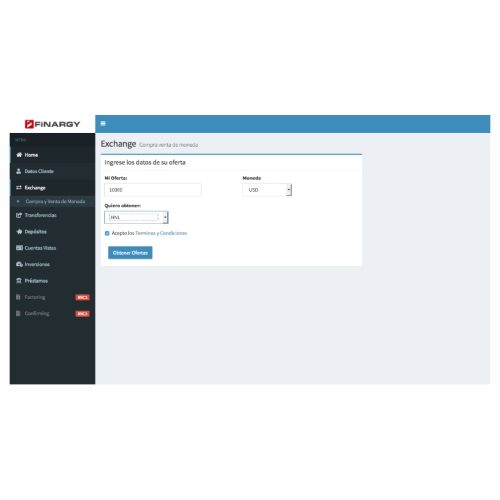

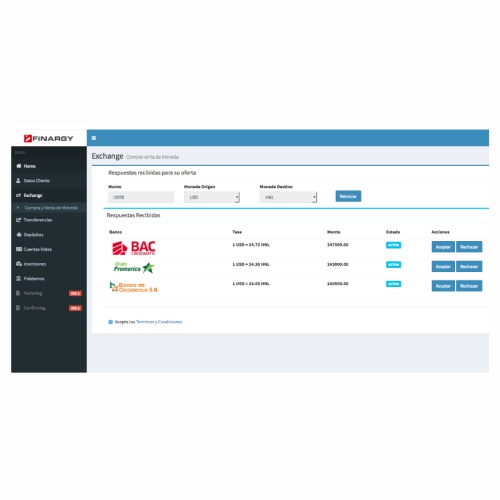

Por otro lado, FINARGY permite mantener un único canal de distribución de productos financieros, lo que permite llegar a más clientes a un menor costo, tomar mejores decisiones de riesgos y captura de clientes, y obtener mayor escala rápidamente. El producto constituye un nuevo canal de distribución, atractivo y de bajo costo, donde los clientes bancarizados y no-bancarizados pueden acceder a múltiples productos de un ecosistema de Entidades Financieras, comparar y seleccionar el que mejor se adapte a su necesidad.

¿Para qué casos de uso se utiliza?

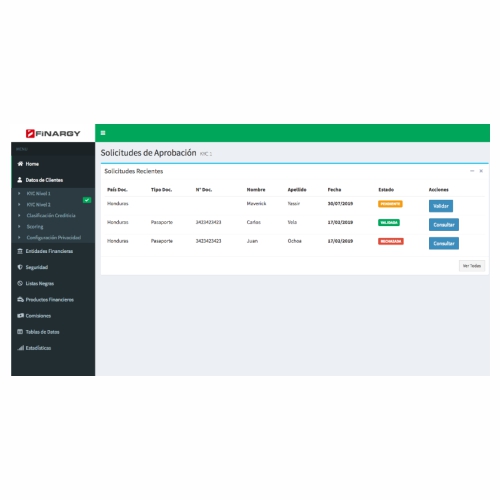

FINARGY permite a un consorcio o grupo de Entidades Financieras reducir costos operativos mediante la colaboración para procesos de KYC, Scoring, Notarización de Documentos:

- En el caso de KYC el proceso de validación se realiza una sola vez para todas las instituciones asociadas, evitando realizar la misma tarea por múltiples instituciones.

- Para Scoring se consolida la información en la Blockchain la cual puede ser consultada por todas las instituciones que tengan acceso adecuado.

- En relación a Notarización de documentos, este proceso permite certificar y validar documentos que deban ser compartidos entre varias instituciones y terceros. El dueño del documento es quien da acceso y permisos de consulta a quien considere adecuado.

Por otro lado, FINARGY permite atraer nuevos clientes al ecosistema mediante un Marketplace de productos financieros, aumentando la cobertura de mercado y maximizando la experiencia de los clientes.

- Permite a los clientes acceder en un único lugar a múltiples productos de múltiples instituciones, compararlos y seleccionar el que le resulte de su conveniencia.

- Permite atraer clientes no bancarizados o que no pertenecen al ecosistema e incorporarlos de manera económica.

El acuerdo con Bantotal es una alianza clave para el desarrollo y expansión de nuestro producto. Bantotal es un core bancario líder en la región, con una filosofía abierta y alineada con nuestro modelo de negocios y filosofía. FINARGY es el socio perfecto de Bantotal para liberar la sinergia de los ecosistemas financieros dentro de la era del Open Banking.

Breve descripción de la empresa:

FINARGY fue creada por integrantes de la empresa Blockbear Blockchain for Business. Está integrada por expertos de tecnología, blockchain y negocios, con una amplia trayectoria en el mercado de TI. El emprendimiento surgió a partir de un trabajo de investigación sobre los casos de uso y el potencial de la tecnología Blockchain en la industria financiera. La investigación se centró en el análisis de casos de uso a nivel global, pero con aplicación a nivel regional y local. Estuvo conducido por expertos de negocios y tecnología de la empresa BlockBear y asesorados con expertos de industria de Banca.

Más Información